Also referred to as the “Edge Strategy” for brevity’s sake.

One can assume that Indexes tend to go up, and generally that would apply to leveraged ETFs as well. The challenge is to avoid, or at least reduce in a meaningful way, the drawdowns associated with those moves while capturing gains generally better than Buy and Hold. Part of the issue is finding the right time to add positions in order to avoid higher drawdowns and still capture those gains.

This strategy, designed to run on the TradingView platform, focuses on volatile, liquid leveraged ETFs to capture gains equal to or better than Buy and Hold, and mitigate the risk of trading with a goal of reducing drawdown to a lot less than Buy and Hold. It has had successful backtest performance to varying degrees with TQQQ, SOXL, FNGU, TECL, FAS, UPRO, NAIL and SPXL. Results have not been good on other LETFs that have been backtested.

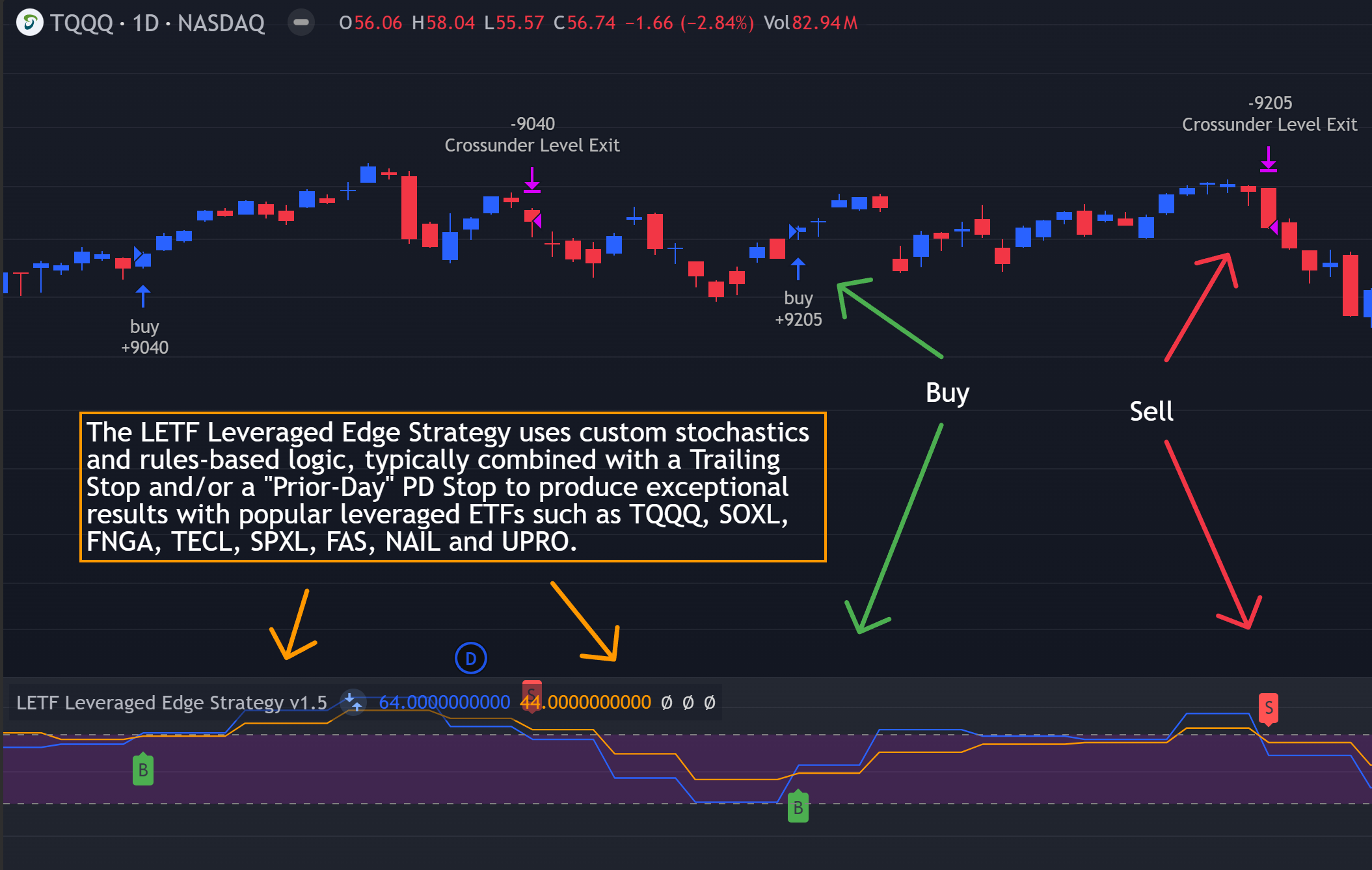

This is a TradingView chart that shows candlestick prices in the top portion with signals labeled that the strategy has generated to take action such as “Buy,” and the position size. Below that is the strategy where the “flat” looking portion of each blue and orange line represent a one week period with small labels such as a Green colored “B” for Buy. Below that is a standard MACD indicator which can also be used by the strategy tool to improve profit performance, and reduce drawdown.

Although the strategy is based on Stochastics, it is not a standard Stochastics implementation. It has been customized and modified, and does not match any widely known Stochastics variations (like Fast, Slow, or Full Stochastics) in its smoothing and iterative calculation process with:

A unique smoothing mechanism.

Iterative calculations.

Additional conditional logic for strategy execution

The conditional logic for strategy execution was developed through a simple, yet very effective, set of rules that users learn after subscribing for the Edge Strategy.

Rules are important as they drive the strategy, and when combined with variable settings, determine when the Edge Strategy will Buy, Sell, or Take Profit. Knowing the rules helps a user anticipate what the strategy may do depending on the market condition. Alerts can be set so if the Edge Strategy does make a Buy or Sell the user is alerted via email or text, but anticipating this beforehand enables a user to be better prepared to take action in a timely manner.

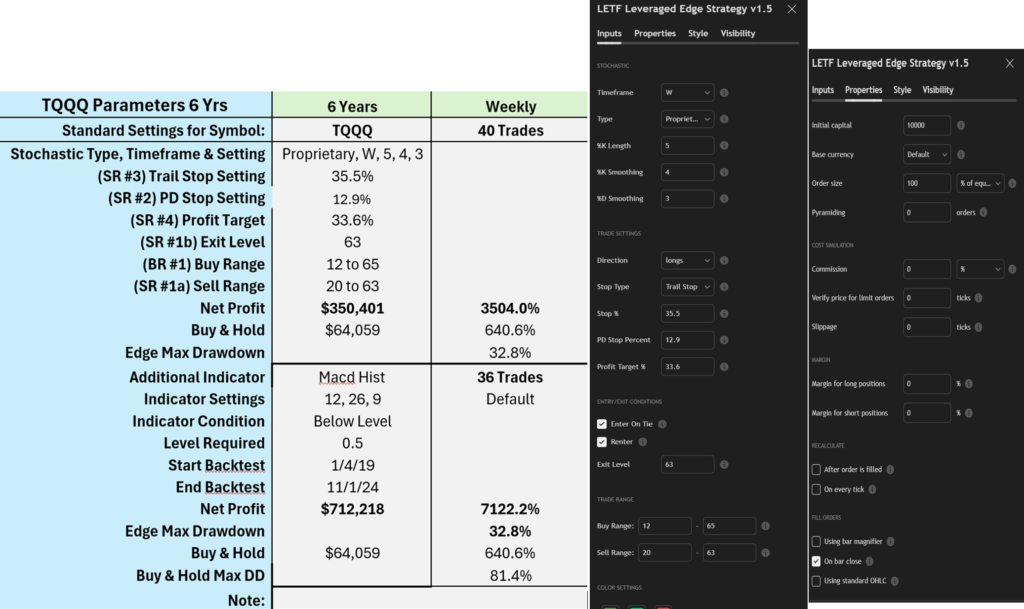

Settings for the TQQQ Leveraged ETF

These variable settings can be tricky and challenging to determine. There are pre-defined suggested settings (see above example) provided for eight different leveraged ETFs to help you get started. These can then be modified based on your preference, trading style and risk tolerance.

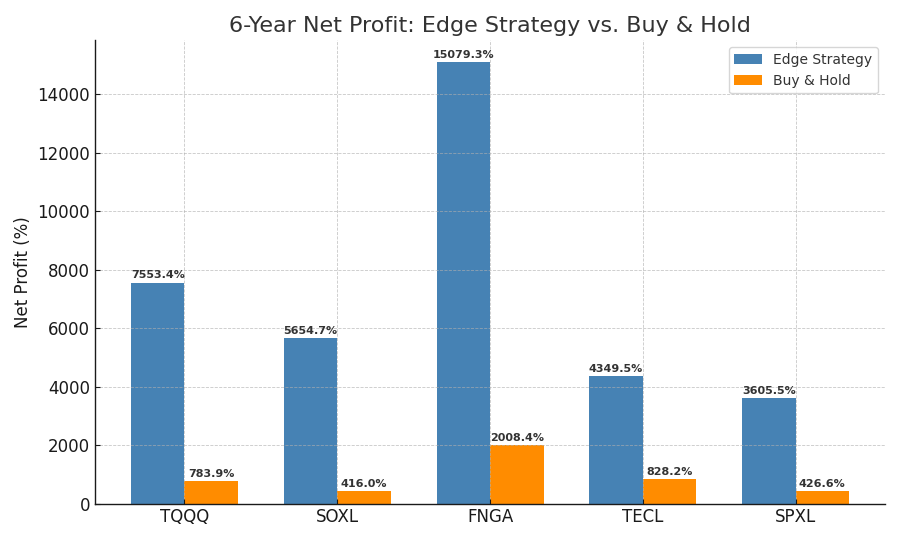

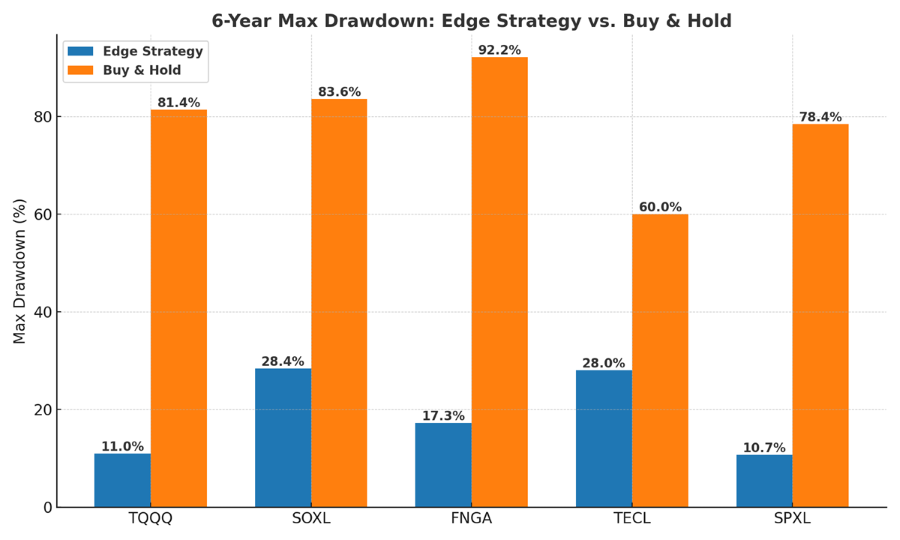

The Edge Strategy has shown very promising backtest results over various timeframes. Performance Results Example:

Performance results Over 6 Year Period (5/17/25 Note: FNGA Recently Changed to FNGB)

Features:

Rules Based Custom Program; written in Pine Script (TradingView) and referred to as the “Edge Strategy” for brevity. Rules easy to use and understand with training available.

Data-Driven Signals: The Edge Strategy tool uses backtested algorithms to generate buy and sell signals, minimize emotional decision-making and provide a structured approach to problem solving.

Customizable Parameters & Pre-Defined Settings: available for TQQQ, SOXL, FNGU, TECL, SPXL, FAS, NAIL and UPRO. Or tailor the tool to your unique trading goals and risk tolerance. This flexibility makes the Edge Strategy adaptable to different trading styles and market conditions.

Risk Management Controls: Integrated risk controls, such as stop-loss and profit taking thresholds, help protect your investment in volatile markets.

Evidence Based Performance: Multiple backtests over varying market periods show historical performance delivered during challenging market periods, and comparisons to Buy and Hold are provided to substantiate the comparable performance with reduced risk provided by the Edge Strategy.

Services:

Having a great strategy to help you with information for buying or selling leveraged ETFs is only part of the equation. Just having it on your chart is not enough. You need to be able to understand what it’s telling you. Anticipating what it will do is even better. You need to be able to modify and change it to make sure it suits your needs. You also need to know that you have accurately set it up so you can use it. That’s where our services come in. When you become an Edge Strategy Member, in addition to access to the strategy you’ll get:

Tutorials:

How the Leveraged Edge Strategy Works

Getting Started with the Leveraged Edge Strategy

How to use “Best Settings”, Add an Indicator and Set Alerts

Rules Training Video, PowerPoint Slides with Examples & How the Rules Help

How the TradingView Strategy Tester can help your performance.

“Using the Leveraged Edge Strategy” in Challenging Markets – and Other Videos Below

You’ll also get:

A written copy of the rules.

A spreadsheet containing suggested “Best Settings & Results” for specific leveraged ETFs to get you going.

LeaveragedEdge on Discord as a resource to ask questions, and a way to participate with other members.

Support to get you the help you need if you get stuck.

Presentation Slides

Let's Trade Smarter Together

If you’re ready to take a more thoughtful approach to leveraged ETFs, we’d be honored to share the strategy we’ve developed and tested over years of experience.

Your guide is just a click away.

Not Familiar with TradingView? The "Preparation" Video Below May Help.

Using the Leveraged Edge Strategy

Disclaimer

Some things you should know:

Before going further, know that this strategy is not perfect. It has limitations or weaknesses that you should understand. LeveragedEdge prides itself on being upfront and as transparent as possible with both positive and negative data.

All users are solely responsible for their own trading decisions. LeveragedEdge, LLC provides no financial, investment, or trading advice and assumes no responsibility for any user’s trading outcomes

Limitations

Past performance is not indicative of future results. Trading leveraged ETFs involves significant risk, including the risk of total capital loss. Only experienced investors using discretionary funds should consider using the Leveraged Edge Strategy.

The performance results shown are based on historical back-tests using example best-practice settings. These results do not account for commissions, slippage, or other real-world trading costs. The Edge Strategy is intended as a decision-support tool and as an educational resource and should only be used as such. Actual trading results will vary based on the user’s modifications to the Edge Strategy settings based on personal goals and individual risk tolerance, how the strategy is implemented, a trader’s individual knowledge and skill, adherence to the rules, platform setup, market conditions, and execution timing. Leveraged ETFs are complex instruments and not suitable for all investors.

This strategy has proven successful backtest results with a very limited set of LETFs as discussed earlier. The author does not know if it will prove successful with any others, or other types of ETFs such as 2X or plain ETFs. A lot more testing needs to be done.

The strategy buys and sells, excluding stops or take profit exits, at the market close. It can be very challenging to enter an order at market close.

Choppy, or sideways markets are the most prone to poor performance and potential for being stopped out multiple times. Market corrections and Bear Markets can be just as challenging, if not more so. Based on our studies of these periods, we’ve developed a series of training videos to help mitigate these challenges and guide you through these periods. Watch our 4-Part Video Training Series on “Using the Leveraged edge Strategy. The 3rd and 4th video’s illustrate some “Trading Considerations” that could be used to get better results during these periods with how choppy markets such as 2015 or Bear Markets such as 2022 could be traded using the Edge Strategy and these Trading Considerations. You can view one or more of these videos above on this page.